This article is also available in Spanish.

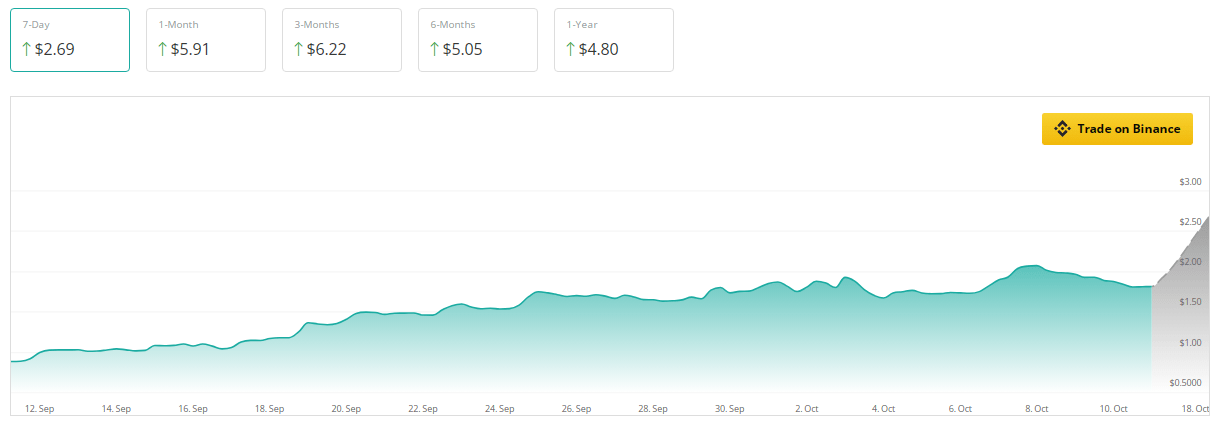

30 days ago Sui [SUI] has been around, tripling its market capitalization and showing impressive growth. The over 100% increase in value drove the token’s market capitalization over $5 billion. But as is always the case with cryptocurrencies, the upside must come down at least temporarily.

Source: Coingecko

Related Reading

The coin’s growth is showing signs of stalling after weeks of increasing momentum. Traders are now looking closely at what might happen next in this once red-hot commodity. According to the crypto price prediction site CoinCheckup, SUI is trading 220% below the expected price for the next month, suggesting that there may be an undervaluation.

Price Slips and Market Activity Declines

SUI was trading at $1.84 at press time after losing 5% of its value in just 24 hours. Based on CoinMarketCap, trading volumes also fell by 4%. This decline in activity suggests, at least for now, declining interest in the token.

Technical characteristics do not seem to be much better. Tracking the inflows and outflows of assets, the Chaikin Money Flow (CMF) has also been at a low level over the past seven days. This is an indication that money is fleeing the SUI, which often leads to price stability problems. Furthermore, the CMF has entered negative territory, suggesting that buying interest is currently under selling pressure.

SUI: Slowing Momentum But Possible Bounce

The token started to sell off as the Relative Strength Index (RSI) dropped below the key signal line, indicating bearish momentum. However, there is a positive aspect here. If the RSI shows a positive turn again, it may indicate a buying opportunity for those who think the SUI has long-term promise.

If the sell-off continues, analysts say SUI could test support at $1.70; this may not be a bad result. Strong support levels attract buyers who see value at lower levels, thus acting as a base for the price to rise again. The SUI will have to overcome its fight over $2, which is a fundamental psychological and technical hurdle, if it is to break out of its current slump.

Fertility Relief

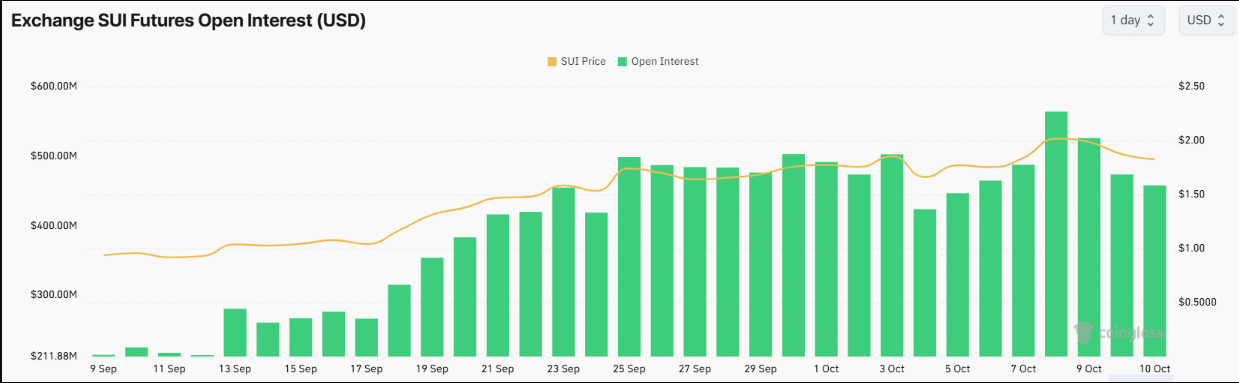

Meanwhile, the SUI, which has recently seen explosive growth, also appears to be cooling down. From a high of $560 million to $450 million, open interest is down 10% in the last 24 hours. This means that traders are closing positions as excitement fades, thus helping to explain the general selling pressure in the currency.

Some traders may see a drop in open interest as a sign of opportunity even in this cooling. Falling prices always mean buyers will re-enter the market, especially if they feel SUI is undervalued.

Related Reading

SUI still has long-term promise. In the next three months, analysts predict a price increase of about 240%; next year, it increased by 160%. For SUI, especially from a long-term perspective, the future looks bright even if the road ahead may be rocky.

Featured image from ThoughtCo, chart from TradingView

Source link