This article is also available in Spanish.

In an analysis shared on X, popular crypto analyst Gum (@0xGumshoe) suggests that Solana (SOL) may rise to $500 by the end of this bull run. This bullish forecast is highly dependent on the outcome of the US presidential election, scheduled for November 5, and the policy changes that may follow.

Solana Price Prediction Yale Bull Run

@0xGumshoe started his prediction with a bold announcement: “SOL TO $500. The upcoming US election will affect SOL more than any other token. That’s why I changed my price.” Looking at possible scenarios, @0xGumshoe examined the results of both possible election outcomes—whether Kamala Harris defends the presidency or Donald Trump returns to office. Each scenario shows different aspects of Solana’s method.

Related Reading

In the wake of Kamala Harris’ victory, @0xGumshoe expects a mixed impact on Solana. He noted, “BTC and SOL have been very successful during the Biden/Harris era,” pointing specifically to last year’s performance under the current administration. The approval of Bitcoin and Ethereum Exchange-Traded Funds (ETFs) during the Biden/Harris era is highlighted by the analyst as a positive thing that could continue to benefit Solana. Additionally, Harris’ commitment to “least abusive crypto” regulation suggests an ideal environment for Solana’s growth.

However, @0xGumshoe also warned of potential challenges under a Harris administration. He noted, “Less regulatory clarity” and a possible new term for SEC Chairman Gary Gensler could make things difficult for Solana. In addition, the opportunity of the Solana ETF area facing rejection and increasing dominance of Bitcoin may overshadow altcoins.

Conversely, @0xGumshoe presented a much better idea if Donald Trump wins the election. He said, “A Trump win will send Solana into ATHs as the market sees the SOL ETF coming.” The analyst stressed that unlike Bitcoin and Ethereum, Grayscale is unlikely to release significant amounts of Solana, which would help stabilize its price. Additionally, the analyst points to the possibility of establishing a Bitcoin Strategic Reserve and the departure of SEC Chairman Gary Gensler as catalysts for SOL.

Related Reading

However, Trump’s victory could also have problems. @0xGumshoe agreed that “higher inflation could end the cycle as early as 2021.” In addition, he noted Trump’s volatile nature, saying the former president “might not do what he promised,” which introduces an element of unpredictability into the speculation.

Due to these circumstances, @0xGumshoe has revised his terms of selling Solana. Previously advocating a sell target of $300, he is now considering a higher limit of $500, based on Trump’s win and capital gains. He explained, “If we pair Trump’s victory and increase capital, I will sell later as long as I believe we hit $500.”

The rationale for the $500 price target is based on Solana’s fully diluted (FDV) valuation. @0xGumshoe said, “At that price, Solana would have a FDV of $291B that I could put in the current ETH market.” He considers this valuation as an important sign, suggesting that Solana’s price could reach Ethereum’s market capitalization unless there is a large influx of investment through ETFs, which would push the token past this threshold.

Under Harris’ tenure, @0xGumshoe Solana’s price target remains at $300. @0xGumshoe concluded his analysis with an advisory, saying, “Elections alone are not enough to predict Solana’s highs so take this with a grain of salt. Whatever happens, it’s clear that SOL will go up a lot more with Trump than Harris. “

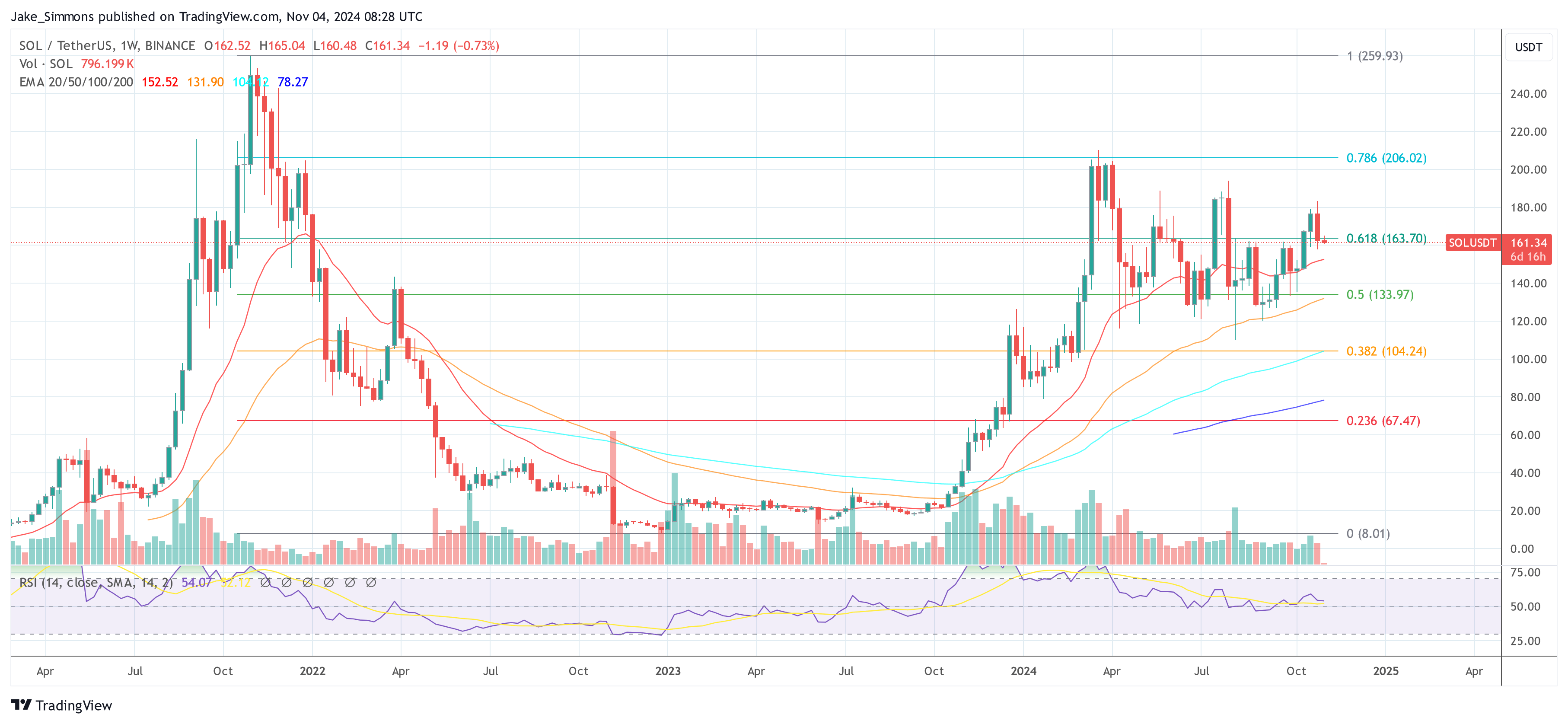

At press time, SOL traded at $161.

Featured image from Coinbase, chart from TradingView.com

Source link