This article is also available in Spanish.

Chainlink is currently trading in a bullish pattern that has been developing for at least seven months, attracting the attention of analysts and investors alike. Many are looking forward to Chainlink growing during this cycle and eventually achieving new all-time highs. The extended consolidation phase has kept traders on edge, as they await a key exit.

Related Reading

Renowned crypto analyst Lucky shared an insightful prediction about how Chainlink will become possible. According to Lucky, the key lies in LINK’s rally above its current consolidation range, which could set the stage for a strong upward move. He suggests that once this breakout occurs, Chainlink could quickly reach the $15 interim target.

With sentiment building around this major resistance level, Chainlink’s price action in the coming days could be crucial in determining its outlook. Investors are closely monitoring the market, looking for signs that LINK is ready to break out of its long-term range and enter a new phase of growth.

Chainlink Price Action Turning Bullish

Chainlink’s price action has been bearish since hitting its annual high in March, and the stock is now stuck in a long-term consolidation phase. However, many analysts believe that this merger may be nearing its end. One leading analyst, Lucky, recently shared a high-level technical analysis on X, offering an optimistic view on Chainlink.

Lucky’s analysis reveals that LINK is trading within a falling wedge pattern, a formation often associated with a potential bullish reversal. According to his chart, Chainlink has touched the lower boundary of this wedge three times, showing strong support, and now seems to be preparing to break out from its annual consolidation range. He predicts that this outbreak will happen in early October, which will probably cause the price of LINK to rise.

Related Reading

Lucky has set several target prices for when Chainlink has exited this consolidation phase. The initial target is $15, followed by more ambitious targets at $19 and $22. These price levels will represent significant gains from Chainlink’s current price and mark a strong recovery from the bearish trend that dominated much of 2024.

As bullish patterns emerge, investors are closely watching Chainlink’s next move, anticipating that a major breakout may propel LINK toward this optimistic price target.

Technical Analysis: Key Values to Watch

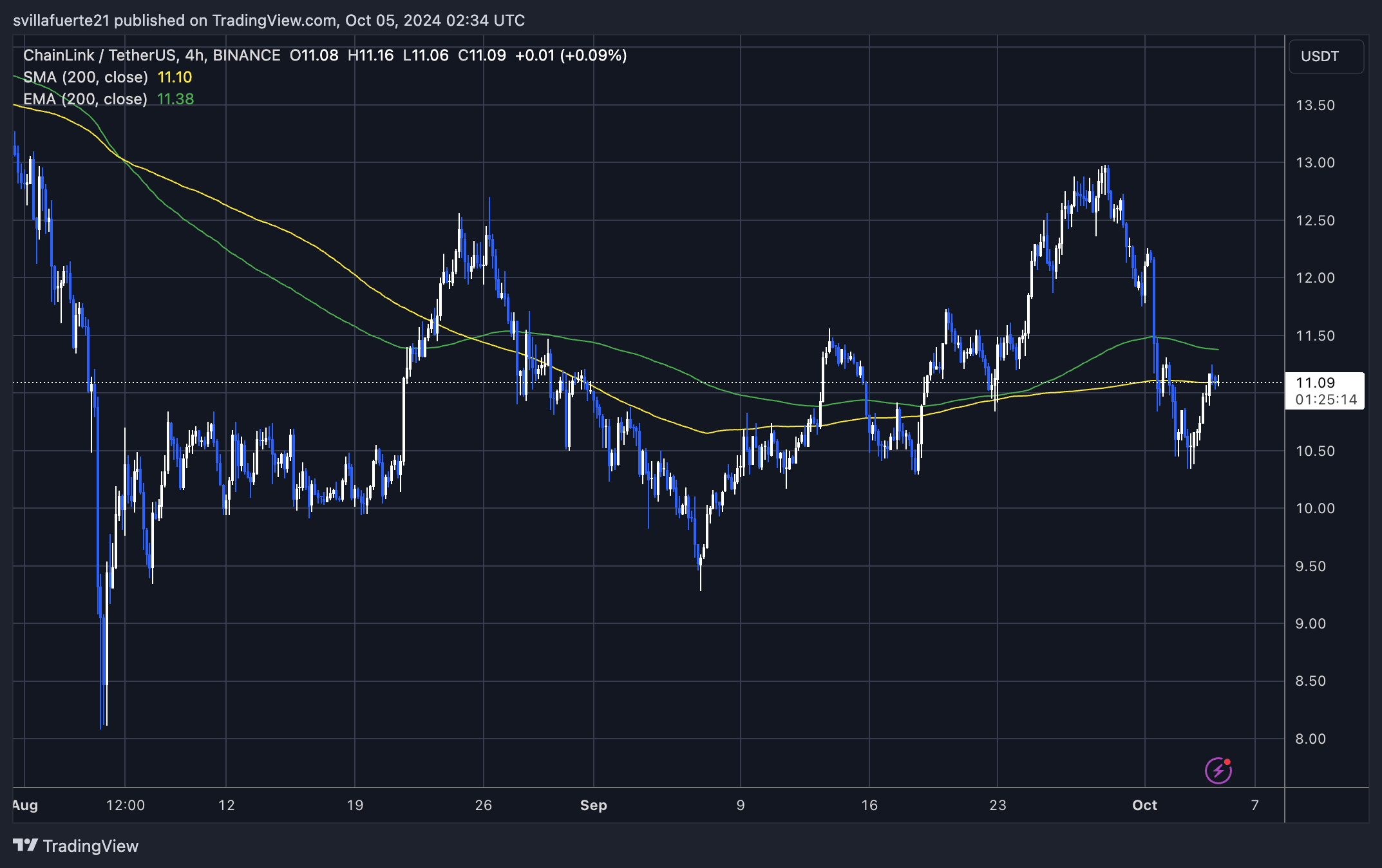

Chainlink (LINK) is currently trading at $11.09 and testing a key resistance level, the 4-hour 200-hour moving average (MA) at $11.10, after a 7% surge since Thursday. This level has become an important obstacle for the bulls, as the price has struggled to break the index. For the bullish momentum to continue, LINK should break through this indicator and target higher supply areas around $13.

However, the current price action suggests that the bulls are finding it difficult to gain strength at this critical level. If LINK fails to break above $11.10 and retests higher resistance, a correction may follow. In that case, the price may reach the desired area, with the next key support level being $9.2.

Related Reading

The coming days will likely determine whether LINK can maintain its upward trajectory or see a price pullback. A successful break above the 4 hour 200 MA would indicate further gains, while failure to do so could result in a bearish correction.

Featured image from Dall-E, chart from TradingView