This article is also available in Spanish.

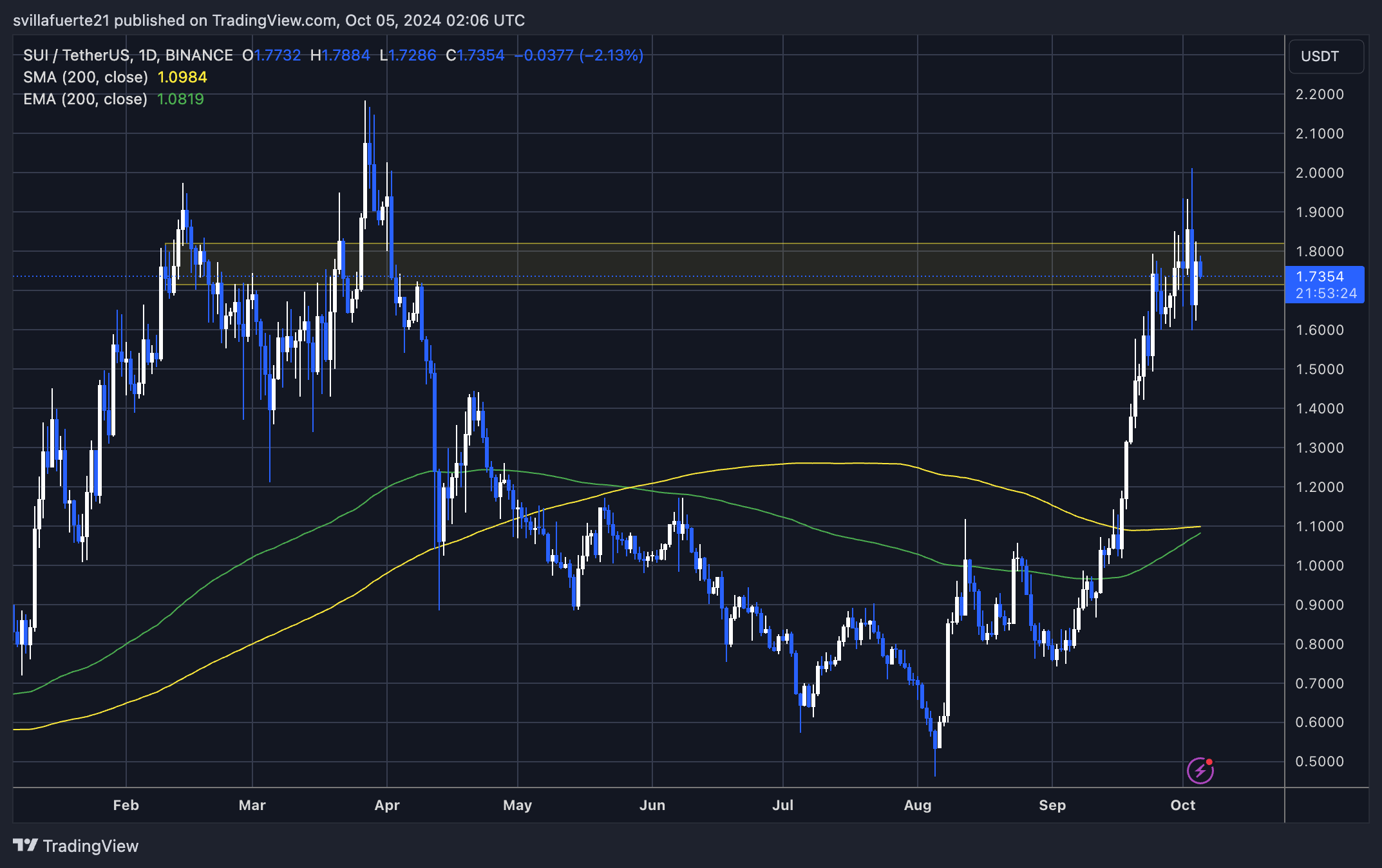

The SUI is currently testing a significant supply zone following a massive 95% surge caused by the Federal Reserve’s recent interest rate cut announcement. The bullish rally, driven by intense buying pressure, has led to volatile price action, raising questions about whether this bullish momentum can be sustained.

As the SUI moves closer to its current highs, market speculation is increasing regarding the possibility of a correction to lower demand levels, with $1.40 being the main target.

Related Reading

Key data from Coinglass reveals a drop in market demand, indicating a possible slowdown in purchasing activity. This has left some investors on edge, as they expect the price to drop in the coming days. The sudden increase has fueled both optimism and caution as traders weigh the potential for continued gains against the risk of a sharp reversal.

With the SUI now in critical condition, the next few days will be crucial in determining whether the bullish trend can continue or if the market will return to stable demand levels. Investors are watching carefully, ready to adjust their strategies based on ongoing price action.

SUI Subsidy Level Signs Price Drops

SUI is in critical condition after days of extreme price action and significant gains. Following its impressive 95% rally since the Federal Reserve’s interest rate cut announcement, some investors and traders are starting to take profits, indicating a possible shift in market sentiment. Many now view a correction to $1.40 as inevitable, especially as buying pressure cools.

Key data from Coinglass suggests a cooling demand, with the funding rate turning to -0.067, which is the lowest on an annual basis. The currency rate is a key indicator in futures trading, representing a periodic payment between traders who are long (betting on the price going up) and those who are short (betting on the going down).

If the support rate of the commodity becomes negative, it indicates that many sellers are opening short positions, expecting the price to drop. This change reflects growing caution in the market as traders begin to position themselves for a possible downside.

Related Reading

With the funding rate so low and demand slowing, the market is showing signs of cooling after the explosive September SUI rally. As a result, investors and traders are now patiently waiting for a correction to reduce demand levels around $1.40, which could present new buying opportunities or a further bearish signal depending on broader market conditions.

Key Points of View

SUI is currently trading at $1.73 after experiencing days of volatile price action. The price rose but stopped at the key $2 level and has entered a consolidation phase just below it. This key level has become a barrier for the bulls, and a push above $2 is needed for the SUI to regain momentum and confirm the bullish trend.

However, the market remains uncertain, and if the price fails to hold the support level of $1.60, a deep correction could follow. Analysts predict that a break below $1.60 could lead to a 20% decline, bringing SUI down to the $1.40 bid area. This level is closely watched by investors and traders as an important support to prevent further pressure.

Related Reading

As the market fluctuates, SUI price action remains a delicate balance between potential gains and further corrections. The next move at these key levels will determine whether the bulls regain control or if the bears continue to lower prices in the coming days.

Featured image from Dall-E, chart from TradingView