This article is also available in Spanish.

Steno Research predicts the best year for cryptocurrencies in 2025, when Bitcoin seems to reach $ 150,000 and Ethereum may hit the value of $ 8,000.

Related Reading

This guess is not just a guess; Steno’s analysis mentions a number of positive economic variables, growing institutional interest, and the growing presence of cryptocurrency ETFs. However, the question remains: can these digital assets reach such amazing milestones?

The Crypto ETF Boom: A Game Changer?

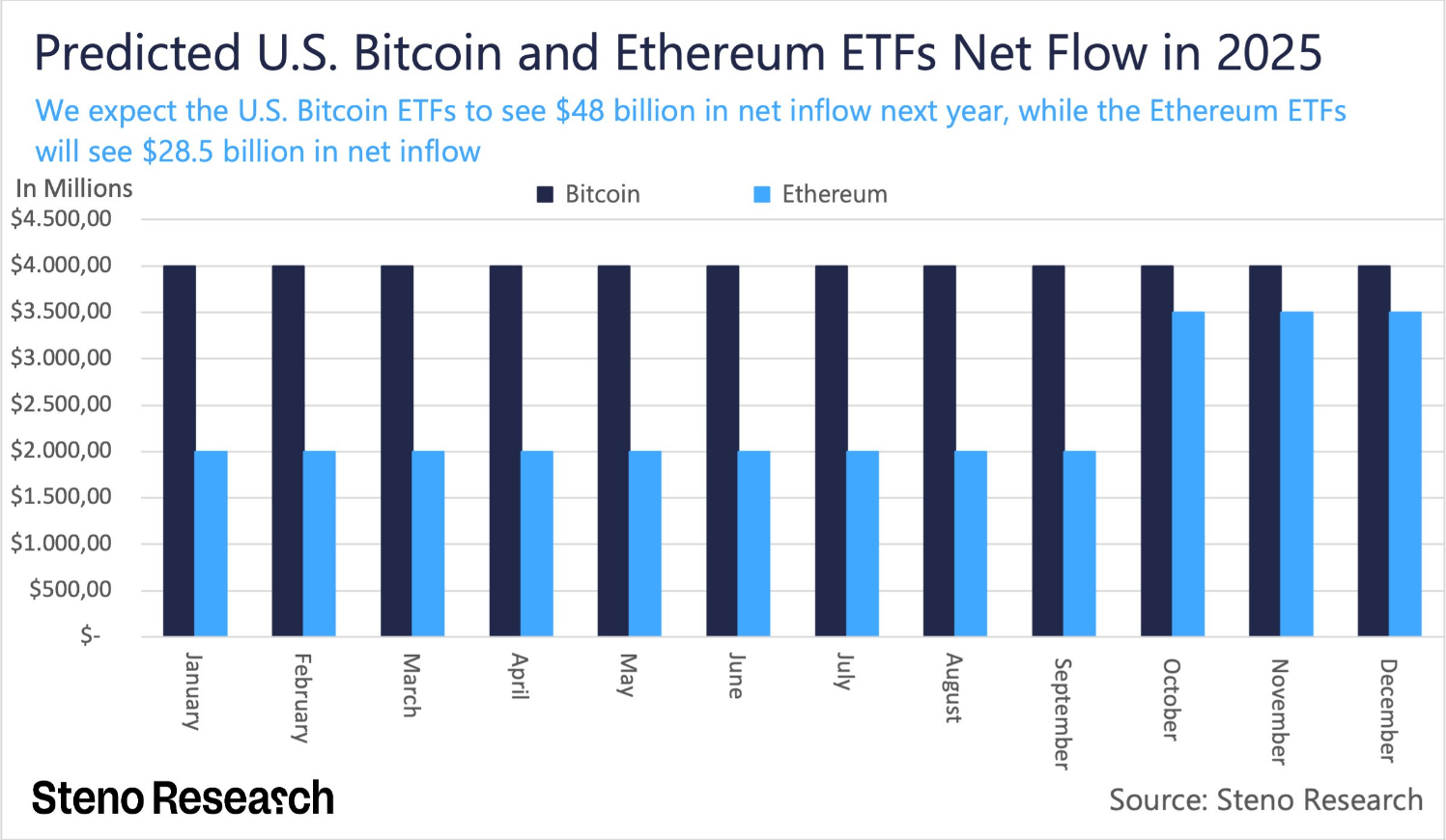

Bitcoin and Ethereum exchange-traded funds (ETFs) will likely play an important role. Bitcoin, in particular, is expected to gain nearly $50 billion in revenue as institutional investors become more interested in these products.

Ethereum is still the biggest player, but it is expected to receive 28 billion dollars, due to similar trends in usage. These funds can bring a lot of money to the cryptocurrency market, which can cause the prices to increase even more.

Similar to 2024, we expect US crypto ETFs to take center stage again in 2025, partly because of the direct buying pressure they exert and partly because they act as a proxy for non-native crypto retail and institutional interest in the asset class.

We project that… pic.twitter.com/T8cs5gEbJy

— Mads Eberhardt (@MadsEberhardt) December 30, 2024

Regulation and the Macroeconomy: The Perfect Storm

Supporting regulations are another key factor in Steno Research’s optimistic forecast. As governments around the world change their sentiments towards digital assets, the financial opportunities of cryptocurrencies are developing.

Bitcoin’s strong price performance in particular appears to be linked to the growing acceptance of cryptocurrency as a viable asset class. This, coupled with favorable macroeconomic conditions, is preparing Bitcoin and Ethereum for dramatic growth in the coming months.

Bitcoin and Long Term Strategy

The study believes that macroeconomic conditions 2025 will support the growth of cryptocurrencies. The popularity of cryptocurrencies as an inflation hedge and store of wealth boosts investor confidence.

This means that ordinary investors have more opportunities to use Bitcoin for long-term portfolio diversification, while Ethereum’s ability to access funds and smart contracts make it an attractive alternative.

Some analysts believe that the price of Bitcoin will rise as consumer and institutional demand increases. Ethereum’s adoption in the DeFi and NFT markets suggests a price increase.

Related Reading

Is 2025 the Year of Cryptocurrency?

The 2025 forecast from Steno Research is optimistic, but not without risks. These rates can be affected by changes in regulations, market volatility, and general economic conditions. However, there is no doubt that Bitcoin and Ethereum have a good chance to climb to new heights, especially if the current trends continue.

According to market forecasts, cryptocurrency markets will soon transition to mainstream use, with new financial products and ETFs making it easier for institutional investors to get involved.

As we begin a new year, the question remains: are we actually on the brink of the best year yet for cryptocurrency, or is this just another speculative bubble about to burst?

Featured image from Dall-E, chart from TradingView