This article is also available in Spanish.

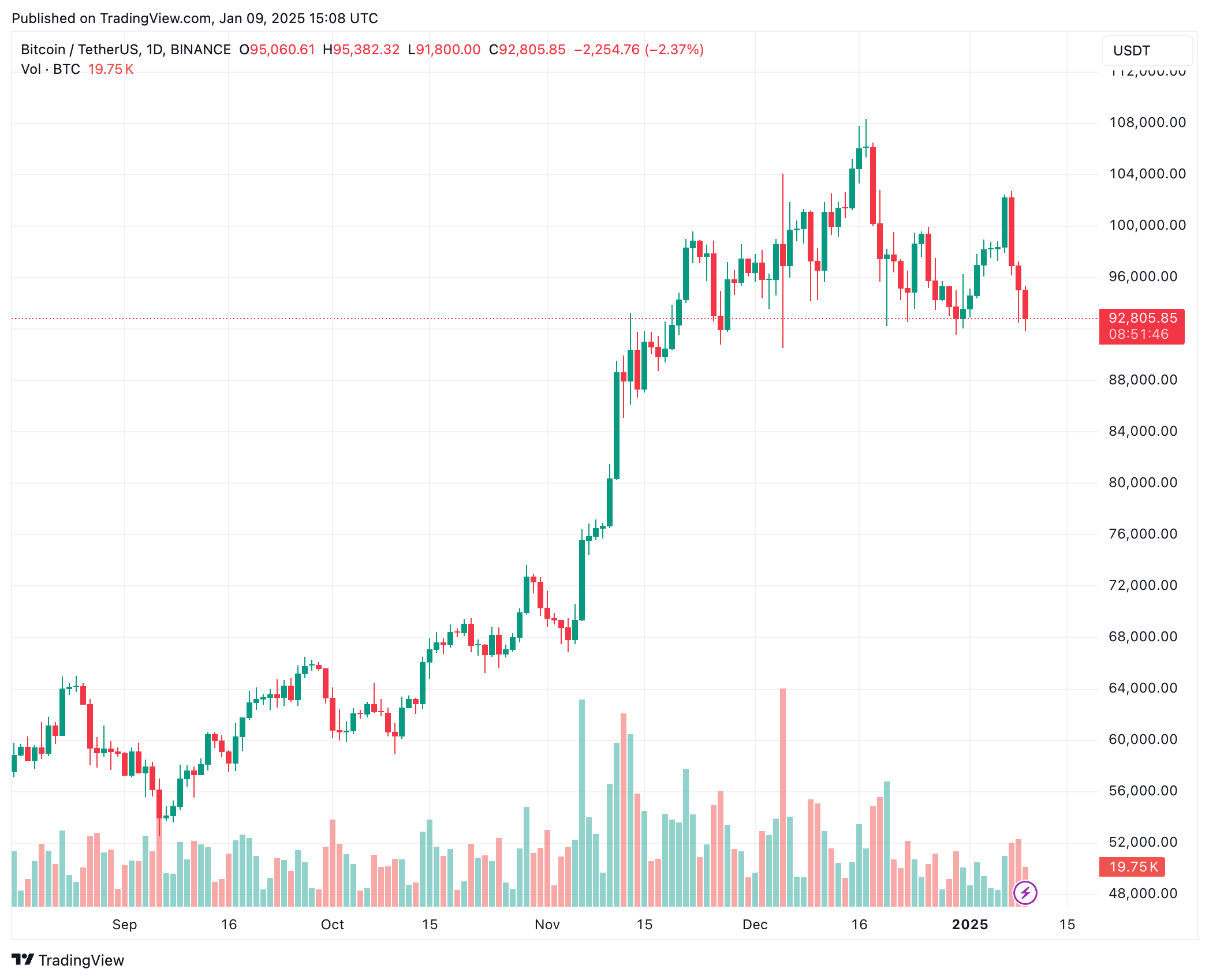

As Bitcoin (BTC) continues its retreat from the low $90,000 range, analysts are divided on how far the top cryptocurrency could fall before a potential bounce. However, long-term market watchers remain optimistic, insisting that short-term price action does not change their belief in BTC eventually rising to a million dollars or more in the coming years.

Bitcoin Will Reach $1.5 Million by 2035

Cryptocurrency enthusiast Timothy Peterson recently shared his predictions on X, predicting that Bitcoin is on track to reach $1.5 million in 2035, based on Metcalfe’s Law. This forecast represents an increase of nearly 15% from its current value over the next decade.

For those who don’t know, Metcalfe’s Law states that the value of a network is equal to the square of the number of its users, which means that as the number of participants increases, the network’s usage and value increases exponentially. In the context of Bitcoin, this suggests that its value increases significantly as more people use the network.

Related Reading

Peterson is the author of a widely discussed paper titled “Metcalfe’s Law as a Bitcoin Price Model”, which uses the law to predict Bitcoin’s price trajectory. Known for his stance on Bitcoin, Peterson has long argued that BTC’s global adoption is inevitable. His paper says:

Conventional currency models fail with bitcoin, but the various mathematical laws that describe the network’s connections provide a solid explanation for its value.

Peterson has also demonstrated accuracy in identifying reversals in key market trends. For example, you are doing well identified The local Bitcoin low was in September of last year.

BTC To Dip Further Before The Jump?

During Peterson’s time bullish $1.5 million prediction is music to the ears of Bitcoin bulls, the current cryptocurrency price action may leave them uncomfortable. At the time of writing, over $524 million it happened in the last 24 hours, with $136 million in BTC alone.

Related Reading

Crypto analyst Keith Alan weighed in on Bitcoin’s recent price movements, saying “this dip is not a dip.” According to Alan, sell-side pressure is driving the price down, as buyers appear to be waiting for lower levels to buy the essentials. He explained:

It is clear that the selling side is trying to lower the price. It is not clear if the buy walls are related to the same business that is lowering the price, but what is clear is that they are not responsible for those price levels, and some or all of these purchases may go wrong.

Alan identified $91,500 as a potential support level, with $86,500 serving as a second line of defense. He noted that more than $300 million in bid capital exists within this range, making it possible for BTC to rise again from these levels.

Alan also highlighted that a drop to $86,500 would represent a 20% drop from Bitcoin’s most recent high (ATH) of $108,135. However, if this support fails to hold, there is a danger of BTC sliding to $77,900 to fill the CME gap.

On the contrary, crypto analyst Ali Martinez recently he insisted that BTC may be on the way to $275,000 based on the cup and pattern formation on the weekly chart. At press time, BTC is trading at $92,805, down 3.3% in the last 24 hours.

Featured image from Unsplash, Charts from X and TradingView.com