This article is also available in Spanish.

In the last 24 hours, the price of Binance Coin (BNB) has increased by 5%, indicating a corresponding upward movement. BNB, which recently broke the $600 barrier, is attracting market attention due to bullish momentum indicators.

Related Reading

However, data on CoinCheckup suggests that BNB is trading about 20% below the expected price for next month. This low valuation may be a sign of near-term gains if this trend does not change anytime soon.

Binance Coin: Mixed Emotions & Smart Expectations

BNB’s technical figures show cautious optimism about market sentiment. The Relative Strength Index (RSI) is around 50, indicating a balanced sentiment that is not under much pressure from buyers or sellers.

This neutrality in itself means that the market is not overheated and, in addition, BNB can go up in any direction without a clear, dominant trend. Another very important indicator to watch is the Chaikin Oscillator, and it is currently at 35K. Therefore, there is almost no collection of purchases.

Meanwhile, with no change in market sentiment to attract more buyers to the fray, a lack of revenue could be the factor preventing BNB from continuing to rally.

BNB trading volume increases by 31% within 24 hours, so market activity and interest are increasing. Investor interest is reflected in the volume-to-market exchange rate, currently at 2.46%, and is based on this increase, but what is being tested is whether interest will support the rate hike.

Short-Term Stresses and Trading Volatility

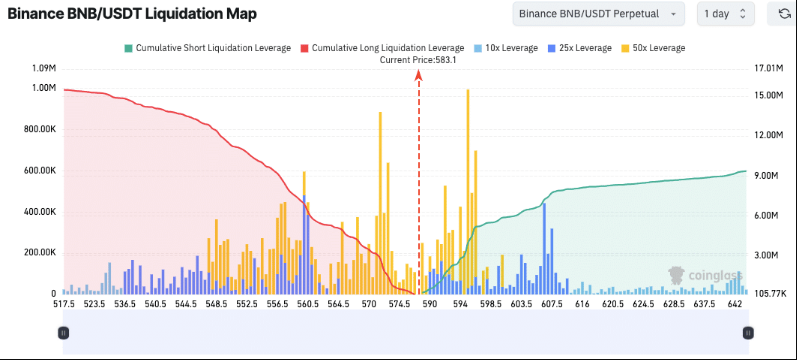

The BNB shutdown map shows areas of concentration that could threaten price stability in the immediate term. The potential for price volatility is there if BNB crosses $590; short positions are concentrated at the $583 level.

This can push these short positions, and later, act as a domino effect that can push prices higher. A long close is initiated when the price falls below $570. This means that if the price of BNB falls, sales can be accelerated as positions are close to being liquidated.

These levels are important points for the short-term trader to watch. Depending on the behavior of the market, price fluctuations at these levels can be dangerous or present opportunities.

Related Reading

Long Term Forecast

With projections showing a potential increase of 60% in the next three months and a subsequent increase of 30% within six months, the outlook for BNB remains optimistic (although it is important to remain cautious). Furthermore, the expected growth rate of 53% suggests that the 12-month forecast is strong, promising for investors.

The recent activity of BNB token burning – which resulted in the direct destruction of 1.77 million tokens (estimated to be worth about $ 1 billion) – appeared as the main reason for this positive feeling.

This reduction in supply is important for price stability and the growth of BNB for long-term investors. Each burn increases the number of tokens left, but the volatile market makes it uncertain how these changes will play out.

Featured image from DALL-E, chart from TradingView

Source link