This article is also available in Spanish.

Ethereum has seen a sharp drop of 14% in less than two days, raising concerns throughout the crypto market during the selloff that began earlier this week. The bearish sentiment has left many investors depressed, as Ethereum struggles to find higher price levels. Frustrated by the consistent underperformance, some investors began to lose faith in the altcoin giant, looking for opportunities elsewhere.

Related Reading

Despite the negative sentiment, senior analyst Ali Martinez shared an optimistic view on Ethereum. Martinez’s analysis suggests that a drop to the $2,900 level could present an excellent “buy-the-dip” scenario for long-term investors. According to Martinez, this potential drop will set the stage for Ethereum to target higher levels, with a bullish price target of $7,000 in the coming cycle.

Current market conditions have created uncertainty, but many experts believe that the coming months will prove the value of Ethereum. As the altcoin leader weathers its latest decline, investors and traders alike are closely watching key support levels to assess whether ETH can bounce back from this decline. With Martinez’s bullish target on the horizon, could this dip pave the way for Ethereum’s next big rally?

Rocky Start in 2025: Hope Remains

Ethereum has faced a rough ride in 2024, with underperformance following Bitcoin’s dominance. The new year did not provide much relief, as Ethereum started 2025 with further declines, leaving many investors frustrated. While Bitcoin continues to command attention, fueling what some call the “Bitcoin cycle,” altcoins, including Ethereum, have tried to gain momentum.

However, not all hope is lost. Senior analyst Ali Martinez recently shared an optimistic view on X, suggesting that Ethereum’s current price action may be setting the stage for significant future gains. Martinez’s analysis points to a possible drop to $2,900 as the best opportunity for Ethereum. He emphasized that this level will represent a good “buy-the-dip” situation, which may set the stage for Ethereum to target a significant $7,000 in the next cycle.

According to Martinez, continued bearish price pressure is a natural part of the market cycle. Once this phase is over, Ethereum can be used by a large assembly. However, for this bullish narrative to materialize, Ethereum must first regain significant levels of demand to revive investor confidence and build momentum.

Related Reading

As Ethereum navigates these tumultuous times, analysts and traders are keeping a close eye on key support levels, waiting to see if this dip actually heralds Ethereum’s next big move.

Ethereum Price Holds Key Support Amid Bearish Pressure

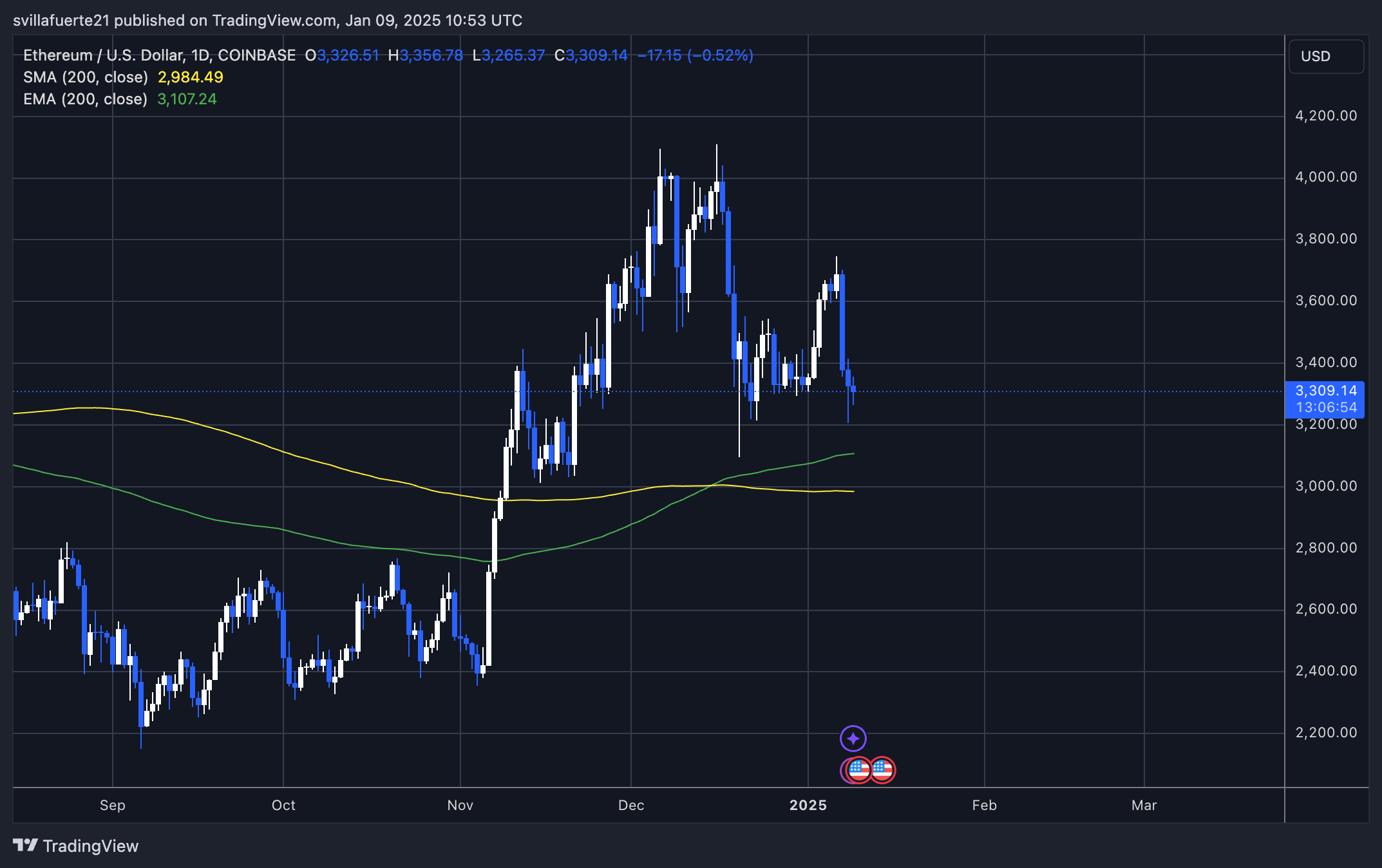

Ethereum is trading at $3,300 after enduring a sharp sell-off that brought the price down to $3,206, creating a sense of fear and uncertainty in the market. Despite the aggressive decline, Ethereum’s price action is showing resilience, setting a new high low on the daily time frame. This subtle change in structure offers hope for a potential recovery, indicating that demand can be quietly built.

For Ethereum to regain its momentum, the bulls need to recover the $3,900 level quickly. This critical area serves as a gateway to reestablish a strong uptrend and boost market confidence. However, the recovery path may take some time as Ethereum stabilizes and recovers from its recent bearish phase.

Related Reading

Although the market situation remains cautious, Ethereum’s ability to hold above key support levels suggests that a faster rally may follow if demand picks up. Investors and analysts are watching these levels closely, expecting a breakout that could mark the start of a new bullish cycle. For now, patience is key as Ethereum navigates this challenging phase, aiming to position itself for strong price action in the coming weeks.

Featured image from Dall-E, chart from TradingView