This article is also available in Spanish.

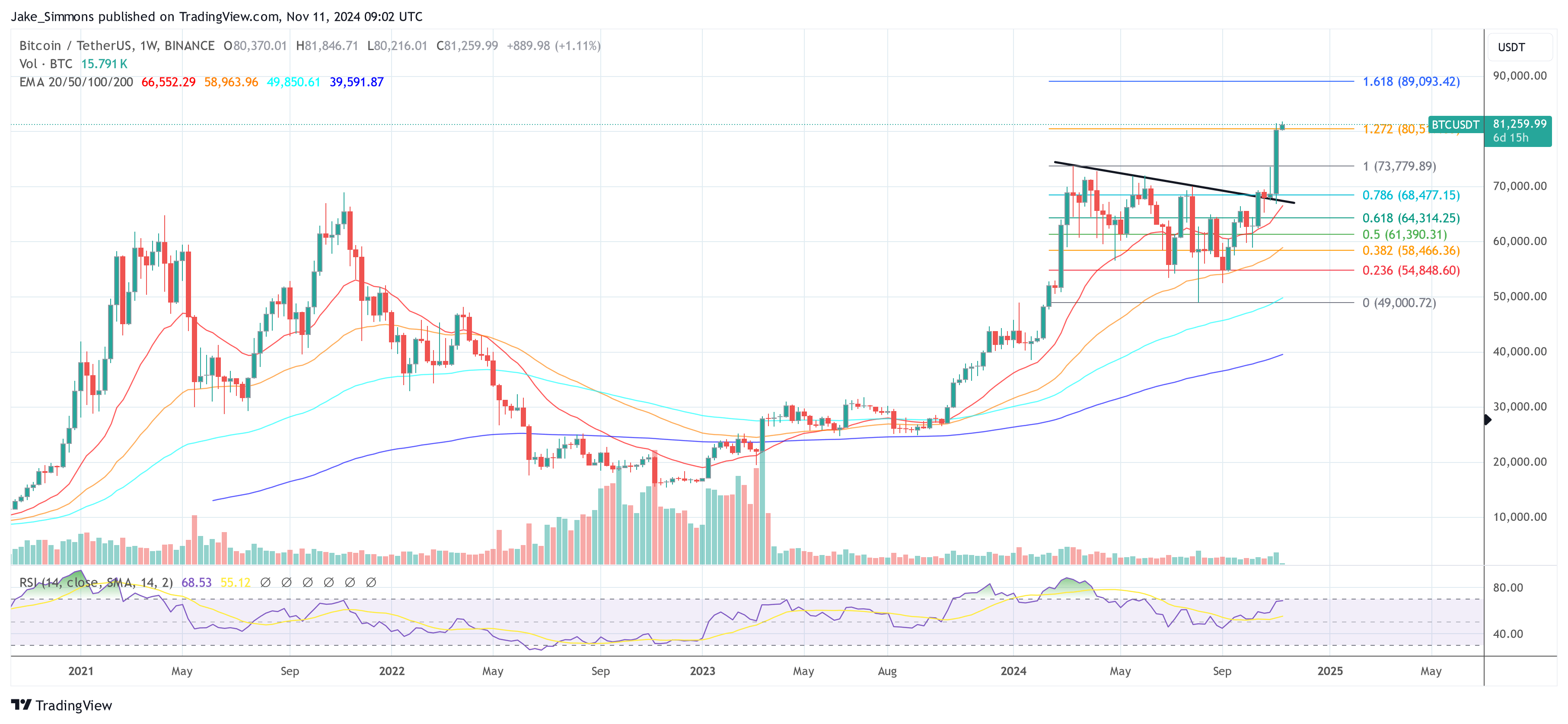

Bitcoin passed the $82,000 mark on Binance, marking a massive 17% increase since the public announcement of Donald Trump’s victory in the latest US presidential election on Wednesday, November 6. Last weekend, the price of BTC made a rare “weekend pump” , accumulates more than 6%. While there are several reasons for this move, one clear reason is clear: Donald Trump’s victory.

#1 Bitcoin “Trump Pump”

The victory of Donald Trump has greatly strengthened the Bitcoin market, mainly due to his campaign promises and supporting legislation. During his election campaign, Trump promised to establish a national Bitcoin repository by keeping the ownership of 208,000 Bitcoins seized through various legal actions over the years.

Senator Cynthia Lummis, a Republican from Wyoming often referred to as the “Bitcoin Senator” for her strong advocacy, introduced the Bitcoin Act. This rule aims to receive 1 million BTC within a period of five years.

As Bitcoinist reported, Bitcoin storage could become a reality very soon. BTC Inc. David Bailey, a key Bitcoin adviser to Trump, recently said that could be done within the “first 100 days” of Trump’s term.

As a result, crypto research firm Matrixport writes in their latest investor note: “With expectations that Trump will transform US regulatory policies into a more pro-crypto environment, the bullish momentum seems difficult to stop. With his suspension set for January 20, 2025, the market has several weeks to support this meeting.

Related Reading

Arthur Hayes, founder of BitMEX, echoed this hope on X: “Some of you don’t believe that Trump is going to trash the $ and print money. BTC disagrees. Here is the best Bitcoin compared to my new US Bank Credit money supply indicator. The market speaks, listen.

The famous crypto analyst MacroScope (@MacroScope17) went on to elaborate on the results for institutional investors: “It is very important for BTC traders to understand how the game has changed since the election. In the institutional world, investments are made by having a thesis […] It is hard to overstate how much the thesis has now changed for BTC in terms of policy/politics.”

#2 Rumors About Bitcoin Nation-State Adoption

The strategic plans to establish a national Bitcoin reserve under Trump have great geopolitical weight, which may spark a global race to accumulate Bitcoin reserves. David Bailey commented, “The Race for Bitcoin Space has begun,” noting that “the game theory is playing out faster than anyone would have expected.”

Mike Alfred, founder and Managing Partner of Alpine Fox LP, shared his excitement at X: “I just got a call outside of the evening. It was an important person and they said that someone big is buying Bitcoin in a big way tonight. I can hardly believe it when they say the name. Wild. We are going much higher.”

Related Reading

Bailey noted on November 10, “There is at least one country in the nation that has been gaining Bitcoin and now holds the top 5. Hopefully, we will hear from them soon.” His assertion, along with a meme that promotes certainty over speculation. He added by size: “The top bitcoin holder for all users.”

There is at least one nation state that has been gaining Bitcoin and now holds the top 5. Hope to hear from them soon.

— David Bailey🇵🇷 $0.85mm/btc down (@DavidFBailey) November 9, 2024

#3 Short Squeeze

A significant short squeeze also contributed to the rise in the price of Bitcoin. Charles Edwards, founder of Capriole Investments, commented on X: “Circa $1B in tight shorts! From $76 to $81K per weekend. Open interest at the same level as when BTC was trading at $62K. Funding continues to stabilize, a very healthy move. “

Data from Coinglass confirms this, revealing that on Sunday, $133.15 million in BTC shorts were liquidated, with an additional $33 million on Saturday. This massive liquidation of short positions has reduced the selling pressure, thus fueling further momentum in the price of Bitcoin.

#4 Marketing Is Back

The resurgence of retail interest has been another key factor in Bitcoin’s recent rally. Cameron Winklevoss, founder of Gemini, commented on X: “The road to $80k bitcoin is paved with continued demand for ETFs. Not retail FOMO. Less popular. People buy ETFs, not sell them. This is sticky money like HODL. The floor keeps rising. Where are we in the cycle? We have just won the toss, the innings has not yet started.”

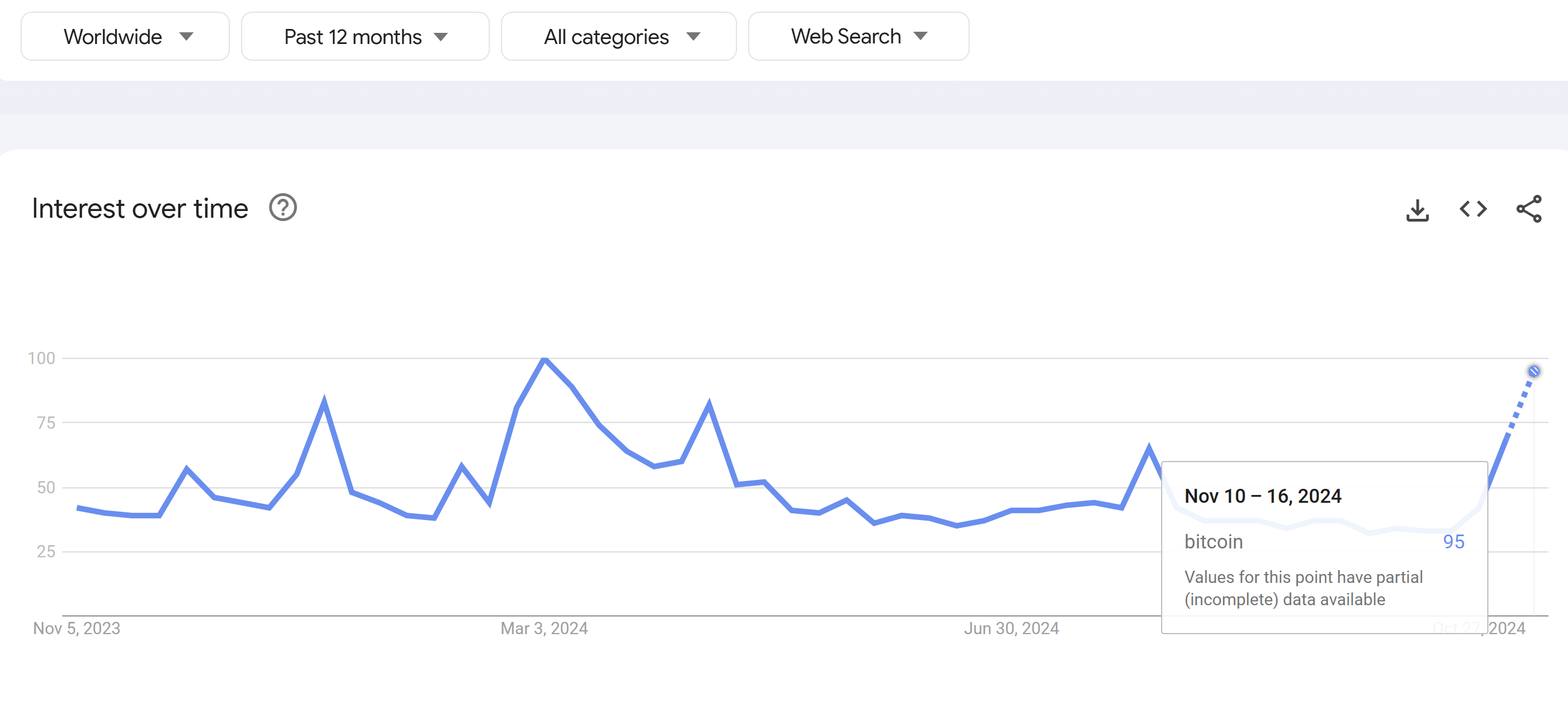

Google Trends data supports this narrative, showing a 53% increase in Bitcoin-related searches since the first weekend of October. On November 10, Bitcoin web searches reached 95, from 42 points at the end of October. This increase in search activity raises retail interest and a potential influx of new investors into the market.

At press time, BTC traded at $81,259.

The featured image was created with DALL.E, a chart from TradingView.com