This article is also available in Spanish.

Bernstein Research, the respected research arm of the global asset manager, AllianceBernstein, predicts that Bitcoin will reach $200,000 by the end of 2025. The company, which has $791 billion in assets under management as of August 2024, labels the forecast as “conservative” of late. The 160-page “Black Book” on Bitcoin.

Why BTC Price Will Reach $200,000 By 2025

Bernstein’s report, titled “From Coin to Computing: The Bitcoin Investing Guide,” examines the various forces driving Bitcoin’s rise. The company emphasizes the increase in institutional acquisitions, the growing market for Bitcoin exchange-traded funds (ETFs), and the evolving role of Bitcoin miners in both the cryptocurrency and artificial intelligence (AI) sectors.

“If you’re a Bitcoin skeptic … maybe a limited supply, a ‘store of value’ digital asset is not such a bad thing in a world where the US debt is reaching new records (35 billion dollars now) and threats of inflation they are still holding. If you like gold here, you should like Bitcoin even more,” wrote Gautam Chhugani, Managing Director and Senior Analyst at Bernstein.

Related Reading

The report highlights a major shift in institutional investment patterns. According to Bernstein, asset managers around the world now hold approximately $60 billion worth of Bitcoin and Ethereum ETFs, a five-fold increase from $12 billion in September 2022. The firm describes the launch of these ETFs as “the most successful in history of exchange traded funds. ,” noting $18.5 billion in annual revenue to date since launching in January.

“By the end of 2024, we expect Wall Street to replace Satoshi as the top Bitcoin fund,” the report said. Bernstein says the outbreak is accompanied by logistical challenges for retail investors. “As institutional players flock to Bitcoin, ETFs are proving to be an entry point for large-scale investments in digital assets,” the firm noted.

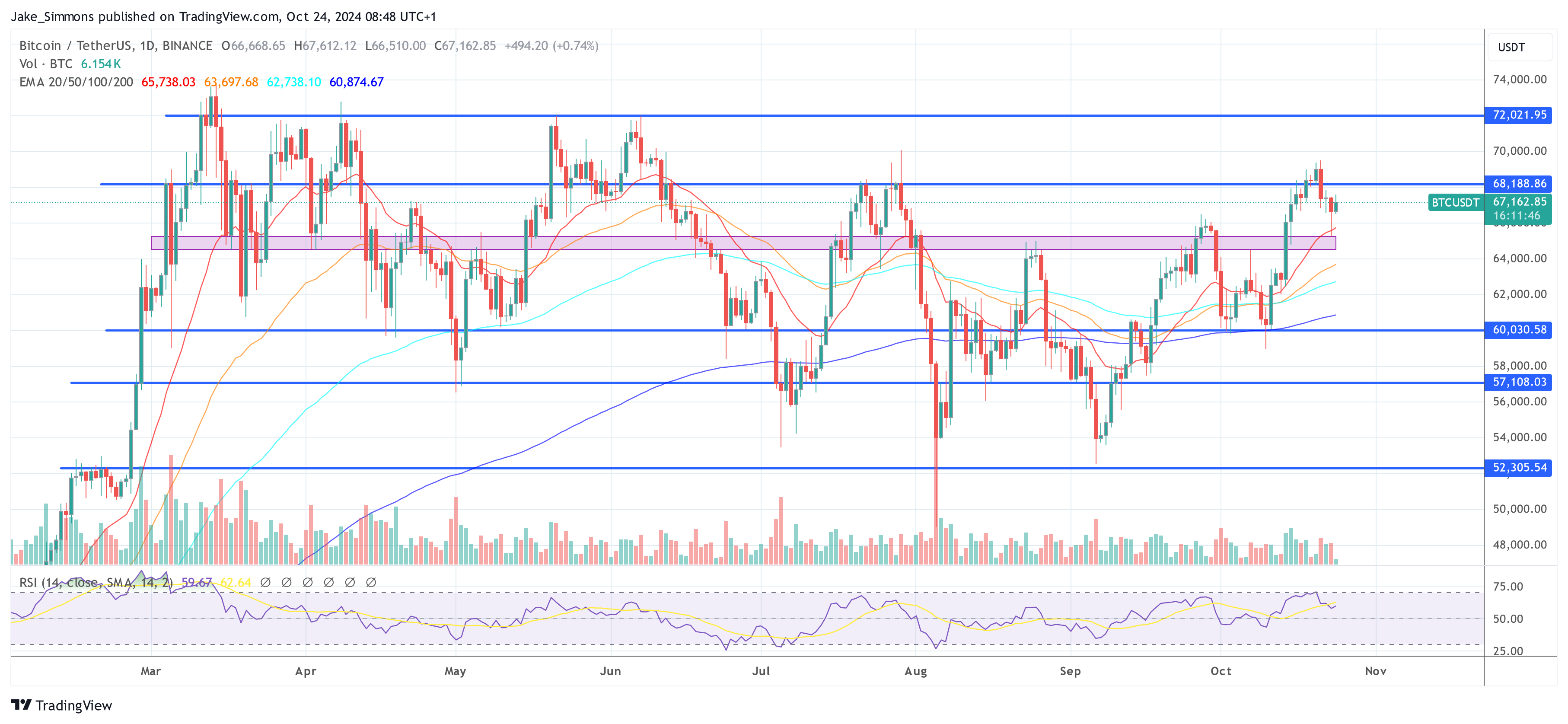

Bernstein’s stance on Bitcoin is based on his analysis of market trends and institutional behavior. The price of BTC has already appreciated by 120% in the last 12 months, with a swelling market capitalization of $1.3 trillion.

“With institutional adoption accelerating, we expect Bitcoin to triple from its current levels,” Bernstein projects. The company expects the Bitcoin market to grow to more than $3 billion by the end of 2025, driven by increased investment from wealth management platforms, pension funds, and registered investment advisors.

The report also suggests that large financial institutions will play a larger role as the market matures. “This new institutional era, in our view, could push Bitcoin to a high of $200,000 by the end of 2025,” analysts wrote, stressing that the forecast is “historical” given the current pattern of institutional involvement.

Bitcoin Treasury and Mining

Another focus of Bernstein’s report is the growing acceptance of Bitcoin as a corporate treasury asset. The company highlights MicroStrategy Incorporated (NASDAQ: MSTR ) as a pioneering example. Led by CEO Michael Saylor, MicroStrategy has allocated more than 99% of its capital to Bitcoin, holding about 1.3% of the total Bitcoin volume.

Related Reading

“We view MicroStrategy as a viable Bitcoin equity strategy,” Bernstein said, pointing out that the company’s stock has provided superior returns compared to holding Bitcoin directly or through an ETF.

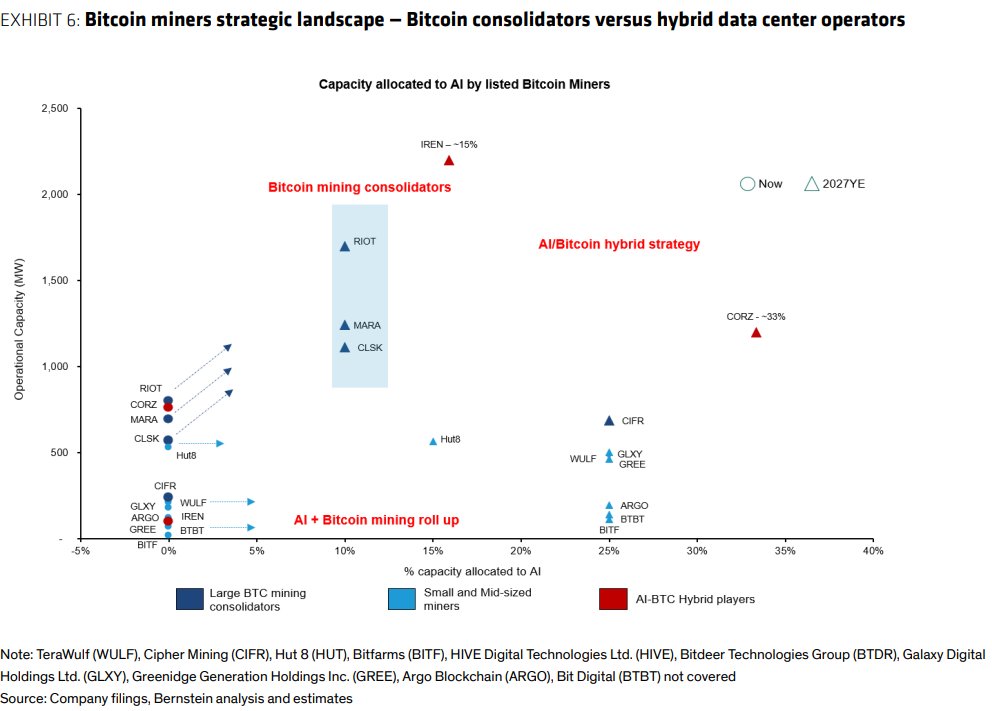

Bernstein’s report also sheds light on consolidation trends within the Bitcoin mining industry. Major players like Riot Platforms (NASDAQ: RIOT ), CleanSpark (NASDAQ: CLSK ), and Marathon Digital Holdings are acquiring smaller miners, leading to an industry dominated by industrial-scale operations.

“Top US Bitcoin miners are consolidating share and becoming powerhouse infrastructure players,” the report notes. “We expect Riot, CleanSpark, and Marathon to consolidate the Bitcoin mining industry.” Bernstein predicts that these top miners will control 30% of the total Bitcoin hashrate by 2025.

Analysts are also exploring the interaction between Bitcoin mining and AI infrastructure. Bitcoin miners are emerging as attractive partners for GPU cloud providers, providing access to gigawatt-scale power and reducing the “time to market” for powering AI data centers.

“Miners present an opportunity to solve energy problems, trading at $2-4 million per megawatt, compared to $30-50 million per megawatt for legacy data centers,” Bernstein noted. Companies like Core Scientific and Iris Energy are capitalizing on this by building AI data centers alongside Bitcoin mining operations.

“Bitcoin miners are evolving into valuable partners for AI data centers as they harness more power and provide efficient solutions for high-performance computing,” Bernstein said. This integration not only diversifies revenue streams for miners but also improves the sustainability and robustness of the AI infrastructure.

At press time, BTC traded at $67,162.

The featured image was created with DALL.E, a chart from TradingView.com

Source link